Leasing a car rather than buying one is an attractive option for drivers who want lower monthly payments and the ability to change to a new vehicle every few years. A lease agreement will usually have a term of between two and four years and at the end of the lease term, the lessee needs to decide how to proceed.

There are various options when a lease contract comes to term. You can return the vehicle to a dealer, buy out the lease (must pay sales tax), or sell your lease to a dealer (avoid paying sales tax). Each of these will have pros and cons and some will incur costs so it is important to assess your options before deciding your best step.

The majority of leaseholders opt to turn in their cars at the end of the lease period so we'll concentrate on the charges you can expect in this scenario.

There are three main types of termination charges that feature in every lease and some others that crop up depending on the types of leases, loan terms, and individual lease companies.

The three main termination fees are: disposition fee, excessive wear fee, and excess mileage charge.

Disposition Fee

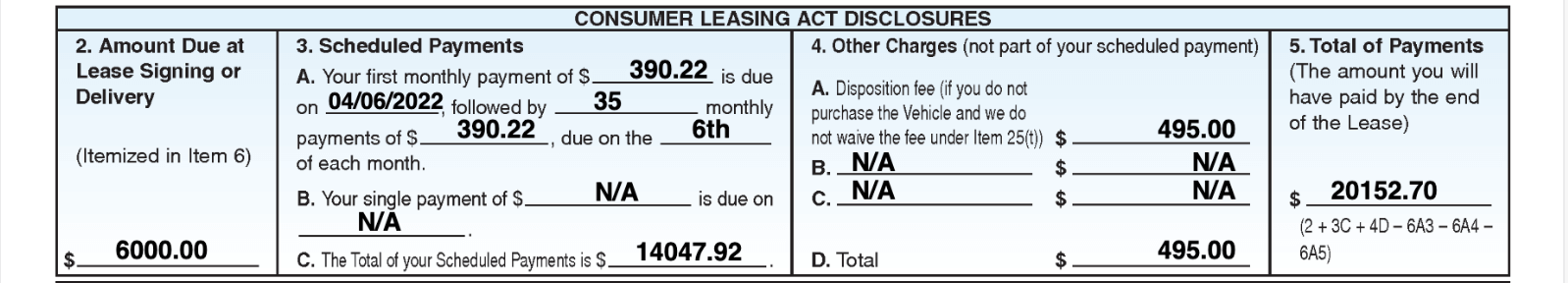

Disposition fees must be detailed in the lease agreement in the end of lease charges - disclosure is required under the Federal Reserve's Regulation M.

Also known as the turn-in fee, ostensibly, this might be simply described as a fee for the privilege of returning your lease vehicle at the end of the contract. It is meant to cover the cost of the dealer/leasing company prepping the car for sale, re-leasing, or for auction.

A disposition fee can be anything from $200 to $700.

This fee is unavoidable on a lease vehicle return even if you return the vehicle in near showroom condition. It is also not a charge that you could have negotiated during the leasing deal. The dealer has no say in the matter because the vehicle disposition fee is set by the lender.

You cannot get out of paying it by withholding it in any way because it will be deducted from the lease security deposit or any cash that is due back to you at the end of the lease agreement.

Excessive Wear Fees

As a lessee, you do not own the vehicle so to provide some security for the lease provider, car lease contracts allow for normal wear and tear.

It recognizes that no vehicle is going to remain in pristine condition when it is driven but there is a penalty fee for excessive damage. The condition of your vehicle at lease end will be minutely scrutinized to assess its condition.

If your leasing company publishes a guide for what is considered normal and excessive wear and tear, it is a good idea to review your car against it. It will give some very heavy hints as to what will be checked during the inspection.

So the question is, what is acceptable wear and tear for a lease vehicle? What is classed as excess wear?

Each car manufacturer advises or sets guidelines for what they consider acceptable wear. Acceptable might include a specific number of stone chips in the paintwork, chips under a certain size in the windshield and nicks or minor scuffs to the wheels, wheel covers and hubcaps. Wear on tires will also be checked.

Typically you can expect damage fees for the following:

- Repaired bodywork that doesn't meet the manufacturer's standards

- Over allowable size chips or cracks in the windshield

- Any chip in the windshield of any size if it is in the driver's line of sight

- Scrapes on alloy wheels

- Tires with a tread depth of less than 3mm

- Retreaded tires

- Tires with sidewall repairs

- Damaged upholstery - holes, tears or burns

- Aftermarket upgrades - custom wheels and tires, custom bodywork, custom seats, performance upgrades and audio system modifications.

You can save money on excess wear fees at lease termination by looking after your car every day.

Rotate your tires to help achieve an even level of wear. Get noticeable chips and cracks in the windshield fixed. Get damage to alloy wheels repaired.

Keep the car clean. Use the car wash regularly and vacuum the interior. Treat any upholstery stains as soon as possible.

Giving the impression that you have looked after the car will hold you in good stead with auto dealerships. This includes routine maintenance tasks including making sure that fluid levels are within the recommended range, tires are set to the auto manufacturer's standards and that oil and air filters have been changed at appropriate intervals.

Excess Mileage Fees

Simply, the higher mileage a car has, the less it is worth. The annual mileage allowance helps the finance company funding your lease car to estimate its resale value at the end of the lease period.

When you sign a leasing agreement, you are committed to a number of miles per each year of the lease. Choosing the right mileage allowance for your car finance or lease deal is extremely important. Not only does it affect your monthly payments but it will affect your end-of-lease charges if you exceed it.

The cost of excess miles can really add up. Excess mileage fees are generally 15 cents per mile for cars with an MSRP of less than $30,000 and 20 -25 cents per mile on cars with an MRSP of $30,000+. So, if you exceed your allowable mileage by 5,000 miles in a car worth $35,000, you will incur $1,000 as a mileage penalty.

Be as accurate as you can when setting your annual mileage limit. Err on the cautious. It might mean slightly higher monthly lease payments but you will avoid penalties for exceeding your allowable miles at the end of the lease.

If you do fewer annual miles than stated in your lease contract, the car may be worth more to the leasing company at the lease end but you will not get a retrospective discount/refund. If you are not driving as many miles as you originally estimated, you may be able to negotiate a lower mileage allowance and lower monthly payments for the remainder of your lease term.

If you want to avoid unfair or excessive additional charges at the end of your lease, consider selling your lease to IMX Auto. IMX Auto is a reputable vehicle buying center and offers the best bargain in lease buyout prices. All makes and models of purchased, financed, or leased vehicles are considered.